Midcap refers to businesses and stocks that fall between large-cap and small-cap categories. The value of midcaps ranges from ₹5,000 to ₹20,000 crore. The company’s market value may fluctuate, causing this flexible classification to change. The market capitalization of a company is determined by the total number of shares it owns as well as the value of each share.

Due to the special combination of stability and growth potential that midcap stocks offer, investors searching for investment opportunities in the Indian market frequently choose them. This article looks at the top midcap stocks in India that have drawn interest from investors because of their promising past performance and future prospects.

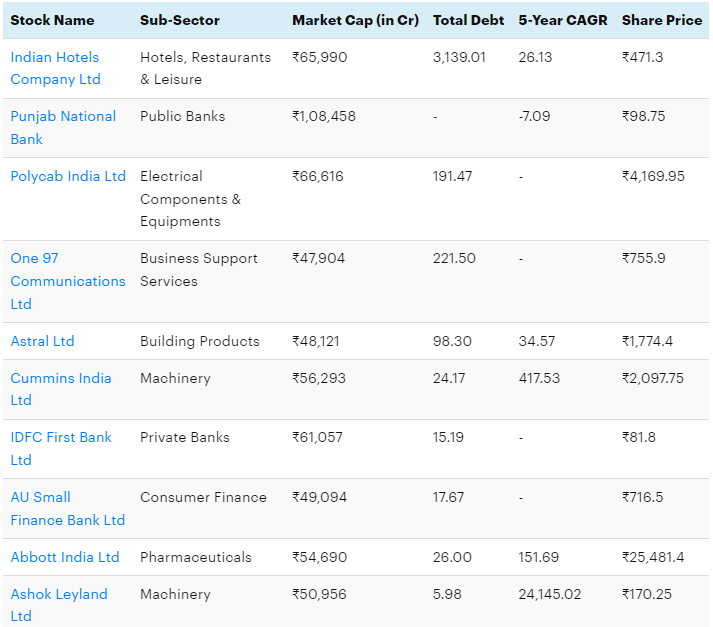

1.Indian Hotels Company Ltd

The Indian Hotels Company Limited is a prominent holding company involved in short-term accommodation, restaurant, and mobile food service activities. In the last 12 months, it made an operating revenue of Rs. 6,010.21 Cr, showing a significant yearly growth of 85%. With a strong pre-tax margin of 22% and a commendable return on equity (ROE) of 12%, it stands out as one of the top mid cap stocks for long-term investment in India in 2024.

2.Punjab National Bank

Punjab National Bank (PNB) is a leading public sector bank in India, offering a wide range of banking services including digital banking, personal banking, social banking, micro, small and medium enterprises banking, agricultural banking, and corporate banking. Over the past 12 months, PNB has achieved an impressive operating revenue of Rs. 106,590.57 Cr, demonstrating robust annual revenue growth of 12%. While the pre-tax margin stands at a respectable 5%, there is room for improvement in the return on equity (ROE) which currently stands at 3%. Nevertheless, PNB is deemed as one of the top midcap stocks for long-term investment in India.

3.Polycab India Ltd

Polycab India is a renowned manufacturer and seller of impeccable wires, cables, and fast-moving electrical goods, solidifying itself as a leader in the industry. Under the esteemed ‘POLYCAB’ brand, the company offers a remarkable product line, encompassing electric fans, LED lighting, luminaires, switches, and switchgears.

Impressively, on a trailing 12-month basis, Polycab India has achieved a staggering operating revenue of Rs. 15,260.60 Cr, showcasing an outstanding annual revenue growth of 16%. The company’s dedication to excellence is evident through its remarkable pre-tax margin of 12%, ensuring a healthy financial performance. Furthermore, Polycab India has achieved an exceptional return on equity (ROE) of 19%, accentuating its success and profitability.

As we venture into the future, Polycab India is poised for even greater heights. It is undoubtedly one of the most promising mid-cap stocks for long-term investments in India in 2024. With its strong market presence, exceptional product quality, and consistent growth, Polycab India continues to be a beacon of success in the electrical goods industry.

4.CCL Products LTD

CCL Products Ltd is India’s largest coffee processor and exporter. They convert raw coffee beans into instant coffee powder and granules. The company has top global private-label coffee clients and also sells its own private-label coffee brand. Strong domestic business, a new plant in Vietnam, and growing international demand will support volume growth. The company is constantly expanding its capacity. Price changes in coffee do not impact the company’s EBITDA. Increasing value-added variants and small packs are expected to enhance margins. The company has achieved impressive annual turnover volume growth and aims to increase market share.

5.Astral Ltd

Astral has demonstrated an impressive financial performance, boasting a robust operating revenue of Rs. 5,420.10 Cr. in the past 12 months. This showcases an outstanding annual growth rate of 17%, a testament to the company’s strong capabilities and strategic decisions.

Furthermore, Astral boasts a healthy pre-tax margin of 12%, a clear indication of the company’s efficiency and effective cost management. In addition to this, the commendable return on equity (ROE) of 16% speaks volumes about Astral’s ability to generate value for its shareholders.

With such promising financial indicators, it is clear that Astral is positioned as one of the best midcap shares to invest in the Indian share market in 2024. Harnessing the tremendous potential for growth and a track record of success, Astral presents an exciting opportunity for investors looking for sustainable returns.

6.Cummins India Ltd

Cummins India (NSE) has achieved an impressive operating revenue of Rs. 8,258.69 Cr. in the past 12 months, demonstrating a remarkable annual growth of 26%. Notable financial metrics include a pre-tax margin of 18% and an exceptional return on equity (ROE) of 21%. This positions it as one of the top midcap stocks to consider for investment in India in 2024.

7.IDFC First Bank Ltd

IDFC First Bank has achieved an impressive operating revenue of Rs. 31,884.84 Cr. in the last 12 months, showcasing a remarkable annual growth of 34%. With a healthy pre-tax margin of 12% and a fair ROE of 9%, there is clear potential for further improvement.

8.AU Small Finance Bank Ltd

AU Small Finance Bank has achieved an impressive operating revenue of Rs. 10,750.85 Cr. in the past 12 months, demonstrating outstanding annual growth of 34%. It is noteworthy that the bank attained a commendable pre-tax margin of 20% and a solid ROE of 13%.

9.Abbott India Ltd

Abbott India has achieved a remarkable feat by generating a robust operating revenue of Rs. 5,642.70 Cr. in the past 12 months. The company has demonstrated commendable annual revenue growth of 10%, showcasing its resilience and adaptability in the market. Furthermore, Abbott India boasts an impressive pre-tax margin of 24%, which speaks volumes about its effective cost management and operational efficiency.

Notably, the exceptional return on equity (ROE) of 29% showcases the company’s ability to generate considerable profits for its shareholders. This remarkable financial performance positions Abbott India as one of the midcap’s best stocks to consider investing in India in 2024.

With its strong revenue growth, remarkable profit margins, and exceptional ROE, Abbott India presents an enticing investment opportunity. Investors seeking stability, growth, and consistent returns would be wise to consider adding Abbott India to their portfolio.

10.Ashok Leyland Ltd

Ashok Leyland has achieved an impressive annual revenue growth of 59%, with a pre-tax margin of 5% and a strong ROE of 14%. This reflects the company’s solid financial performance, positioning it as a robust player in the market.

Features of a mid-cap stock

• Mid-cap stocks have a lot of room to grow, which can provide profitable returns for investors.

• Compared to small-cap stocks, mid-cap stocks are less impacted by market swings. When compared to large-cap stocks, they are thought to be much riskier, though.

• Businesses in the mid-cap range are diverse. There are certain businesses that are stable but have low profit margins in the development stage. On the other hand, some mid-cap businesses may be experiencing growth and provide high returns.

Advantages of midcap stocks

- Because of their flexibility, mid-cap stocks can suit both low-risk and high-risk investment strategies. They offer a flexible way for investors to improve the growth and stability of their portfolios.

- Compared to small-cap companies, mid-cap companies have greater potential for growth and a better chance of obtaining credit financing. Additionally, these businesses grow quickly, which may result in higher returns on investment.

- You can make decent long-term returns by continuing to invest in a mid-cap company with solid fundamentals and financials.

- Mid-cap stocks offer a moderate amount of risk, which strikes a balance. In comparison to small-cap stocks, they are more stable and yield higher returns than large-cap stocks.

- By investing in a mid-cap company with strong fundamentals and financials, you can achieve excellent returns over the long term. Mid-cap stocks provide a balanced mix of risk and reward. They deliver better returns than large-cap stocks while also offering greater stability than small-cap stocks.

Who should invest in midcap stocks?

Compared to small- and large-cap stocks, mid-cap stocks might seem to offer a better balance between risk and return, but they might not be appropriate for everyone. The following investors may want to think about buying mid-cap stocks:

- Mid-cap stocks are a good option for long-term investors because they can yield favourable long-term returns.

- Those seeking capital gains may want to think about mid-cap stocks.

- Mid-cap stocks are an option for investors who are willing to take on a moderate amount of risk.

Factors to Consider Before Investing in Mid Cap Stocks

When contemplating investments in mid-cap stocks, it’s crucial to weigh several key factors to make informed decisions tailored to your financial objectives:

- Risk Tolerance: Mid-cap stocks often carry higher volatility than large caps. Assess your risk tolerance to align your investment strategy with your comfort level during market fluctuations.

- Company Stability: Scrutinize the financial health and stability of mid-cap companies. Analyze balance sheets, cash flow, and debt levels to gauge the company’s resilience in varying market conditions.

- Market Conditions: Consider the broader economic landscape. Mid-cap stocks may respond differently to economic shifts than large or small caps. Evaluate current market conditions and potential impacts on mid-cap sectors.

- Growth Potential: Assess the growth prospects of mid-cap companies. Research their competitive positioning, industry trends, and growth catalysts to gauge their potential for future expansion.

- Diversification: Maintain a diversified portfolio to mitigate risks associated with individual stocks. Balancing mid caps with other asset classes can enhance portfolio stability.

- Liquidity: Evaluate the liquidity of mid-cap stocks. Ensure there is ample trading volume to facilitate buying or selling without significant market impact.

Conclusion

Mid-cap companies and shares are those whose capitalization is positioned in the middle of large and small. These stocks on the SEBI list offer reasonable returns, balanced liquidity, and low risks. They have a stronger growth potential and can withstand market volatility better than small-sized businesses. They have regularly outperformed small-cap and large-cap stocks over the last few years. Investors who wish to invest for long-term gains but have a moderate appetite for risk should diversify their portfolios.

Investing in mid-cap companies can be lucrative for Indian stock market investors seeking diversification and growth potential. There are risks, but they can be reduced with careful planning and research. Mid-cap stocks, positioned between larger and smaller companies, present a strong potential for growth and demonstrate resilience in the face of market fluctuations. For investors aiming for long-term returns with a moderate risk appetite, considering mid-cap stocks is a prudent choice. However, before making any investments, it’s essential to conduct thorough research using Tickertape Stock Screener.